CFD stands for Contract For Difference. It’s a financial instrument that allows you to hold the right to the difference between current and settled asset value. You can easily trade Australian shares online using CFDs, but learning more about this kind of trading before starting is recommended as it’s precarious and speculative. But, if you want to try CFD trading with real money, we will provide you with some of the best options from Australia.

What are CFDs?

Contracts for Difference (CFDs) are a type of financial instrument that enables you to bet on the price of an asset without actually owning it. CFDs allow you to trade currencies, shares, and indices. You’re essentially buying and selling contracts; therefore, if your contract is long, you expect their prices to rise; but if your contract is short, you expect their prices to fall. It also implies that open positions are no longer necessary overnight since contracts are marked-to-market every day.

CFDs are complex financial instruments that give traders the ability to make money on both rising and falling markets, making them ideal for individuals who want more control over their capital market exposure.

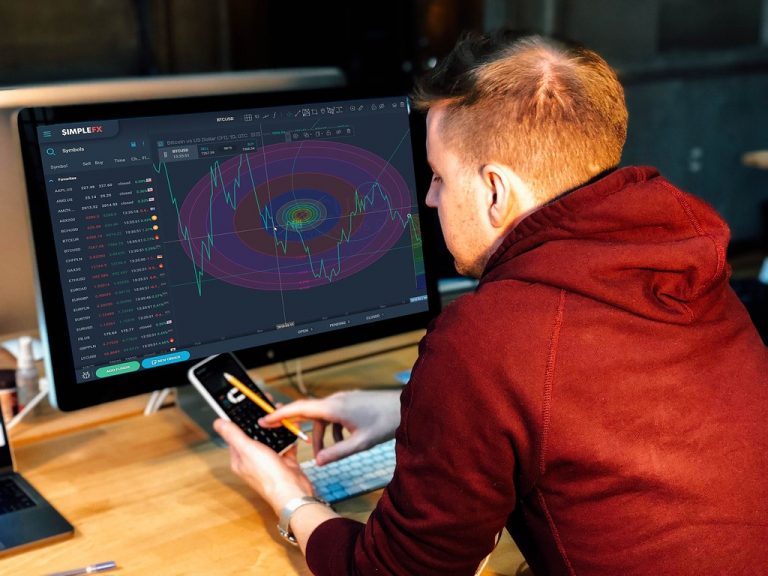

With several platforms now enabling you to buy and sell assets with the click of a button, online trading is becoming increasingly popular in Australia.

Whether you want to trade forex, stocks, commodities, or Bitcoin, the most important thing is that you choose the proper trading platform for yourself. To learn more about it, go to this website.

The top CFD trading platforms in Australia:

Trading Central

This online tool has a clean and easy-to-use interface, and it is beneficial when it comes to charting. It’s an Australian-based site, so if you’re looking for trusted advice, this may be the option for you. The charts can also be saved, which is helpful if you like comparing different time frames or commodities with one another, such as crude oil prices vs gold prices over the last few years (e.g.). Another feature of Trading Central is that it allows users to place conditional orders, such as “Only Buy” orders, which means your order will not go through unless a particular condition is met (e.g. the price must be under a particular value).

InvestingScope

The most outstanding feature of this particular online tool is that it has several years’ worth of historical data and features a spotless interface for quick research. When predicting future prices, it provides accurate results by drawing Fibonacci Retracements levels based on different timeframes.

Another great feature is that users can add tags onto stocks/commodities to bookmark them quickly and easily for an easy portfolio.

One of the most significant disadvantages to CFD trading is that they entail leverage – and as we all know, leverage can equal significant risks and big returns! The common analogy used for leverage is borrowing.

Accordingly, if you were to purchase a property with a 20% deposit (i.e. you put down $200,000), it would be considered leveraged as your loan represents 80% of the house’s actual value (i.e. $400,000).

In other words, you only have to borrow $200,000 but have an asset worth $400,000, so if the prices increase by 1%, so will your equity – fantastic, right? Well, not exactly – you’ve still got to repay that loan – so even though prices increased by 1%, if you couldn’t repay what you borrowed, the bank would still sell your house for $400,000, and then you’d have to pay back that $200,000. It is how leverage works in CFD trading, too – so whilst it can be advantageous, it’s essential to think about risk management before opening a position.

To conclude

CFDs offer traders the opportunity to trade multiple assets with a straightforward contract. Still, this type of trading risk is associated with contracts that entail price exposure without having ownership of the actual asset. If looking for online tools with accurate predictions features For more detailed information such as future prediction charts and tagging stocks, visit this website.